property tax calculator frisco tx

Over 65 65th birthday 30000. One important factor in home affordability in Frisco Texas is your Frisco Texas property taxes.

A tax lien attaches to property on January 1 to secure payment of taxes for the year.

. We found 28 addresses and 28 properties on Ocean Road in Frisco TX. Cities counties and hospital districts may levy a sales tax specifically to reduce property taxes. Property tax calculator frisco tx Monday February 28 2022 Edit.

For comparison the median home value in Texas is 12580000. 22060 Flanagan Circle is within the school districts Little Elm Independent School District with nearby schools including Hackberry Elementary School Lakeside Middle School and Little Elm High School. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

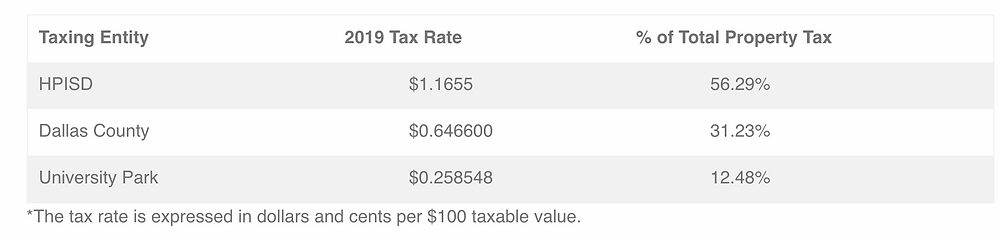

Here is some information about the current Frisco property taxes. The average price for real estate on Martel Place is 574985. Taxing units set their tax rates in August and September.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property. 6101 Frisco Square Blvd Suite 2000 Frisco TX 75034. Property Tax General Information PDF Resources Forms.

Enter your Over 65 freeze amount. Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar. Creating property tax rates and directing appraisals.

Homeowners in these areas should remember to claim the homestead exemption. Frisco Property Taxes City of Frisco Raised Taxes 38 Percent Over Last Five Years. Property Tax Rate NOTICE - Adoption of FY22 Tax Rate PDF Notice of 2021 Tax Rates PDF City of Frisco Tax Rates For Fiscal Year 2021 Collin County.

Enter your Over 65 freeze amount. Frisco collects a 2 local sales tax the maximum local. 181 of home value.

1 The type of taxing unit determines which truth-in-taxation steps apply. Texas has one of the highest average property tax rates in the country. Plano Texas and Frisco Texas.

Taxing Entity Tax Rate. Youll pay only when theres a tax. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property and Registration Taxes and an Online Tool to customize.

All are legal governing units administered by elected or appointed officers. 2007 Exemptions and Property Tax Rates. 6101 Frisco Square Boulevard 2nd Floor Frisco TX 75034 Phone.

Enter your Over 65 freeze year. Taxpayer Rights Remedies. Please select your city.

For example the Plano Independent School District levies a 132 property tax rate and the Frisco Independent School District levies a 131 property tax rate. Enter your Over 65 freeze amount. Texas Property Tax Calculator.

Property taxes are determined by what a property is used for on January 1 market conditions at the time and ownership of property on that date. 469-362-5800 Hours Monday through Friday 8 am. The Frisco Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Frisco local sales taxesThe local sales tax consists of a 200 city sales tax.

Please note that we can only estimate your property tax based on median property taxes in your area. Collin County Tax Assessor Collector Office. The tax rates are stated at a rate per 100 of assessed value.

The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax rate. Along with collections property taxation takes in two additional common functions.

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. Similar properties nearby are 6415 Mountain Sky Rd 4086 Forest Park Ln 3104 Briarwood Ln 7086 Barefoot Dr 6952 Washakie Rd. The average Retail Manager salary in Frisco TX is 47960 as of February 25 2022 but the salary range typically falls between 45854 and 56339.

Tax amount varies by county. This calculator factors in PMI Private Mortgage Insurance for loans where less than 20 is put as a down payment. Texas Property Tax Rates.

Enter your Over 65 freeze year. Our Premium Calculator Includes. Taxing entities include Frisco county governments and numerous special districts like public colleges.

Groceries are exempt from the Frisco and Texas state sales taxes. 6101 Frisco Square Boulevard. The Frisco Sales Tax is collected by the merchant on all qualifying sales made within Frisco.

Homes for Sale in Frisco TX. Tax Data Requests. 2022 Cost of Living Calculator for Taxes.

15910 Trail Glen Dr Frisco TX 75035-1651 is a single-family home listed for-sale at 495000. Overview of Texas Taxes. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

- Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and Taxes with details on state and local sales income property and automobile taxes - Includes the cost of Child Care for toddlers or infants at a day.

Texas Sales Tax Calculator Reverse Sales Dremployee

Conroe Proposes Raising Property Tax Rates Ahead Of Next Year S State Mandated Cap Community Impact

Safest Cities In America 2022 Edition Frisco Economic Development Corporation

Tarrant County Tx Property Tax Calculator Smartasset

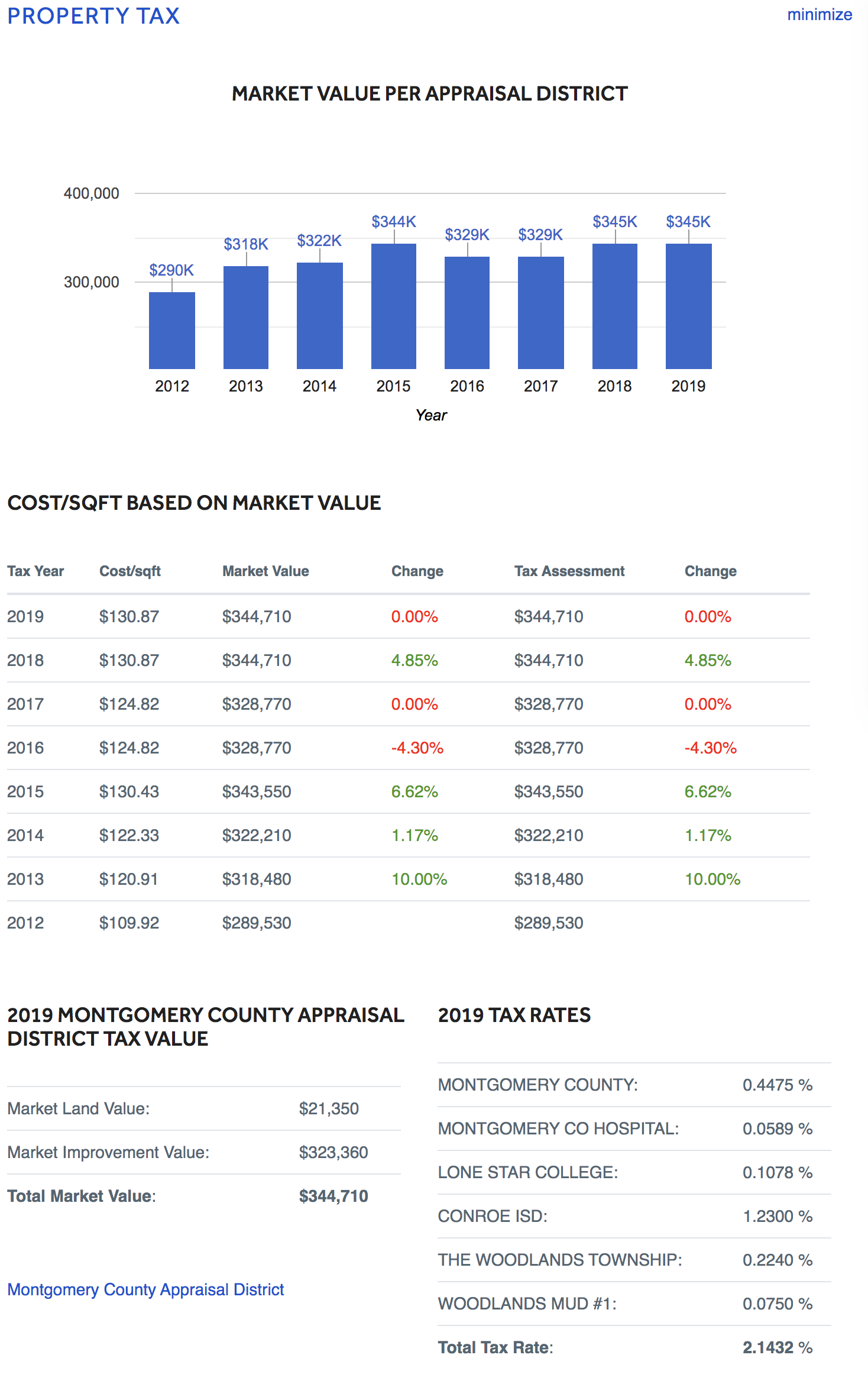

New Construction Neighborhoods With Low Taxes In Montgomery County Har Com

Frisco Real Estate Market Trends And Forecasts 2019

What Is The Property Tax Rate In Irving Texas

Tarrant County Tx Property Tax Calculator Smartasset

Frisco Real Estate Market Trends And Forecasts 2019

What Is The Property Tax Rate In Frisco Texas

Tarrant County Tx Property Tax Calculator Smartasset

What Is The Property Tax Rate In Plano Texas

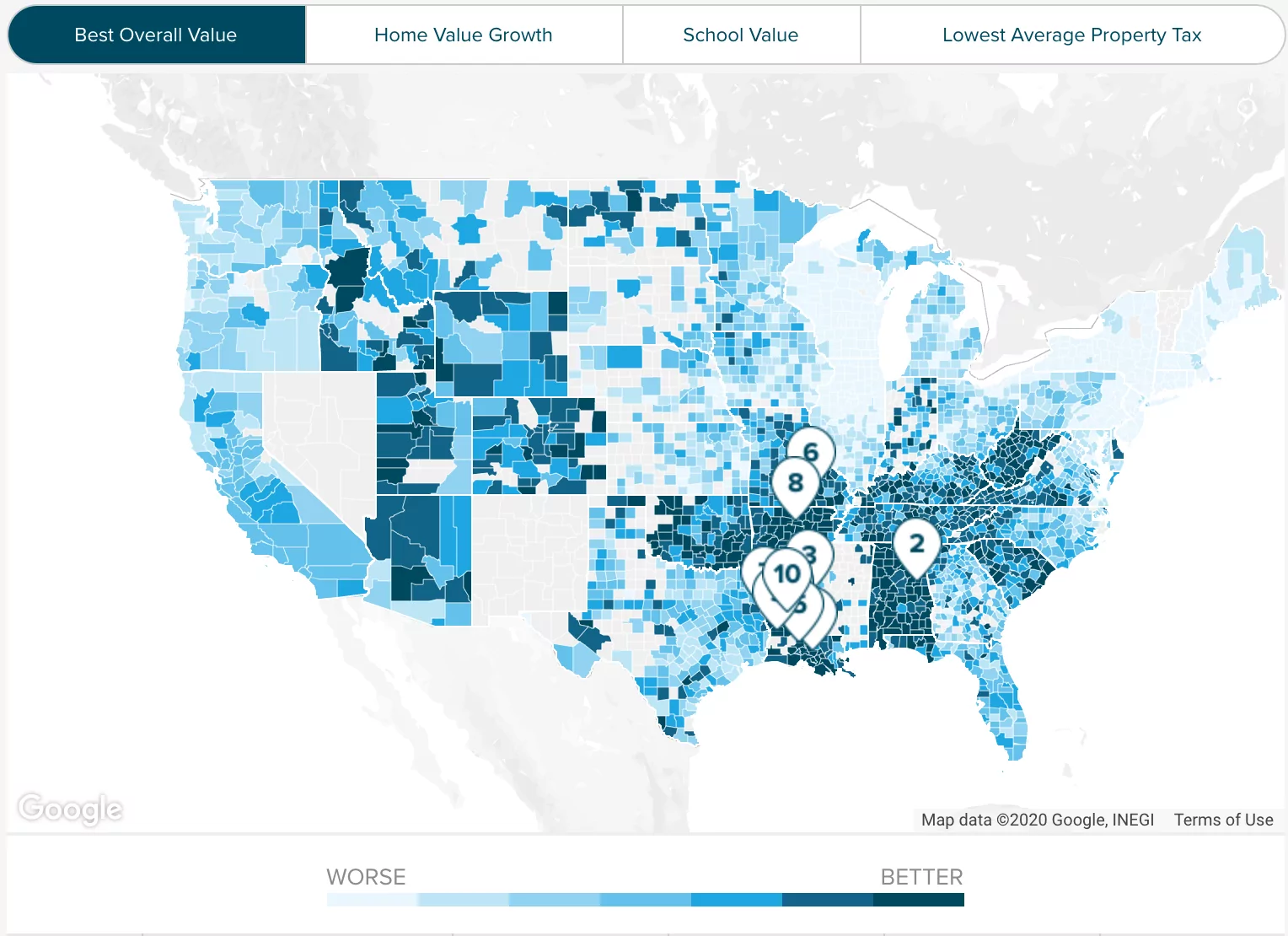

Where Are Lowest Property Taxes In North Texas

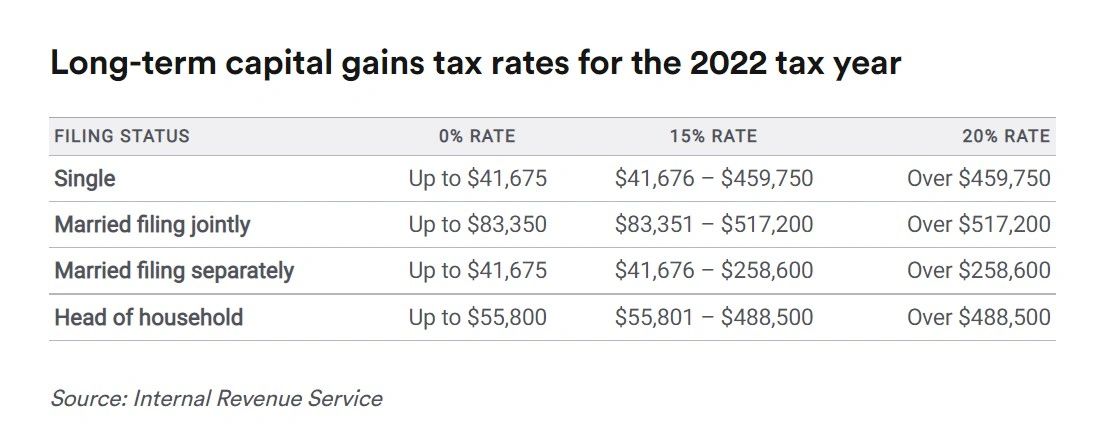

How Much Is Capital Gains Tax See Our Tax Calculator Har Com